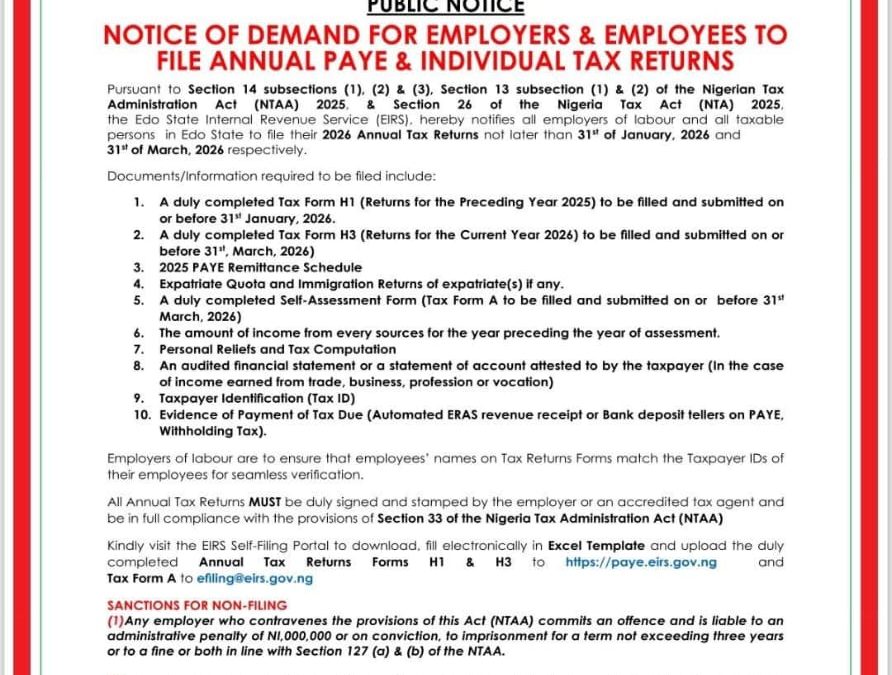

Pursuant to Section 14 subsections (1), (2) & (3), Section 13 subsection (1) & (2) of the Nigerian Tax Administration Act (NTAA) 2025, & Section 26 of the Nigeria Tax Act (NTA) 2025, the Edo State Internal Revenue Service (EIRS), hereby notifies all employers of labour and all taxable persons in Edo State to file their 2026 Annual Tax Returns not later than 31st of January, 2026 and 31st of March, 2026 respectively.

Documents/Information required to be filed include:

- A duly completed Tax Form H1 (Returns for the Preceding Year 2025) to be filled and submitted on or before 31st January, 2026.

- A duly completed Tax Form H3 (Returns for the Current Year 2026) to be filled and submitted on or before 31st, March, 2026)

- 2025 PAYE Remittance Schedule

- Expatriate Quota and Immigration Returns of expatriate(s) if any.

- A duly completed Self-Assessment Form (Tax Form A to be filled and submitted on or before 31st March, 2026)

- The amount of income from every source for the year preceding the year of assessment.

- Personal Reliefs and Tax Computation

- An audited financial statement or a statement of account attested to by the taxpayer (In the case of income earned from trade, business, profession or vocation)

- Taxpayer Identification (Tax ID)

- Evidence of Payment of Tax Due (Automated ERAS revenue receipt or Bank deposit tellers on PAYE, Withholding Tax).

Employers of labour are to ensure that employees’ names on Tax Returns Forms match the Taxpayer IDs of their employees for seamless verification.

All Annual Tax Returns MUST be duly signed and stamped by the employer or an accredited tax agent and be in full compliance with the provisions of Section 33 of the Nigeria Tax Administration Act (NTAA)

Kindly visit the EIRS Self-Filing Portal to download, fill electronically in Excel Template and upload the duly completed Annual Tax Returns Forms H1 & H3 to https://paye.eirs.gov.ng and Tax Form A to efiling@eirs.gov.ng

SANCTIONS FOR NON-FILING

(1)Any employer who contravenes the provisions of this Act (NTAA) commits an offence and is liable to an administrative penalty of NI,000,000 or on conviction, to imprisonment for a term not exceeding three years or to a fine or both in line with Section 127 (a) & (b) of the NTAA.

(2) Any taxable person who fails or refuses to file returns or knowingly files incomplete or inaccurate returns to the relevant tax authority in accordance with the provisions of the Nigeria Tax Administration Act (NTAA) 2025 shall be liable to pay an administrative penalty of N100,000 in the first month in which the failure occurs and N50, 000 for each subsequent month in which the failure continues as stipulated in Section 101 (a) & (b) of the NTAA.

For further enquiries, kindly visit any EIRS Office across the State or visit www.eirs.gov.ng or call 08168091243, 08130970146

SUPPORT AND SUSTAIN GOOD GOVERNANCE & DEVELOPMENT IN EDO STATE.

PLAY YOUR PART. PAY YOUR TAX.

IT IS YOUR CIVIC RESPONSIBILITY. IT IS THE LAW.

SIGNED

Otunba (Hon.) Oladele Bankole-Balogun Esq., ACTI

Executive Chairman, EIRS

1st January, 2026.