Ondo State Internal Revenue Service has ended its two days study visit to Edo State Internal Revenue Service, EIRS with plans to create its own seamless revenue administration system.

Team lead and Director, Personal Income Tax, Ondo State Internal Revenue Service, OIRS,

Segun Enikuomehin, said they gained knowledge from the EIRS blueprint on tax reforms and management.

Venting on the choice to harness the tax experience of EIRS, which he observed was more developed than theirs, he declared, “Ondo State Internal Revenue Service team is here to understudy how to run a seamless tax process. Though the process is still ongoing and open for improvement, we are building upon use of technology to drive the revenue process which follows best global practices for both establishments and allows taxpayers to pay from the comfort of their homes.”

He praised the EIRS Executive Chairman for having a dedicated and versatile management team which satisfactorily took them through the ERAS process.

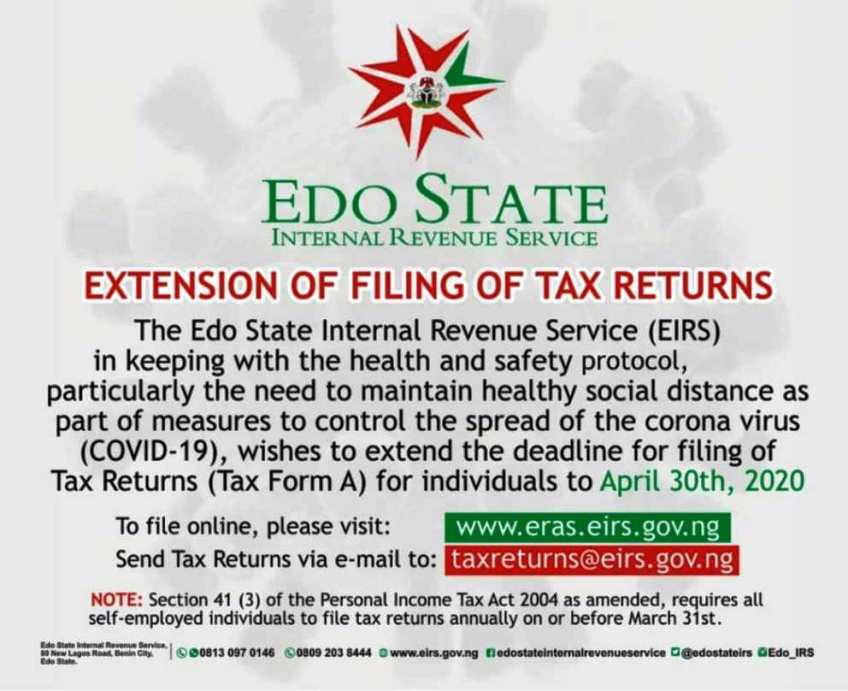

Receiving the tax experts, EIRS Executive Chairman, Igbinidu Inneh gave insights on the workings of Edo Revenue Administration Service, ERAS

ERAS he stated, “is a technological process which birthed owing to the need to efficiently manage revenue administration using technology. It is a system that seamlessly, warehouses different revenue solutions across different revenue streams which helps to capture, profile, assess, notify and enables individual or corporate taxpayers settle taxes.

Inneh noted that ERAS which is ranked as one of the best in sub saharan africa, is a hundred (100%) intellectual property of the EIRS built to manage and automate the entire revenue generation spectrum in Edo State”

He added, the IT solution which has further improve IGR performance, consist of central system, revenue system and mobile system, all geared towards ease of data tracking, tax settlement, electronic treasury receipting and MDAs certificate approvals.”

On hand to share the Service’s experiences and successes achieved thus far with the deployment of ERAS, were the Secretary to the Revenue Service Lilian Giwa-Amu Esq, Executive Director, Other Revenue, Mr. Okodugha Emmanuel, and the Head, ICT Department, Mr. Aliyu Ehizogie, who respectively shared insights on the informal sector, consumption tax, enforcement activities, local government harmonized taxes/ levies and a complete understanding of the ERAS process.