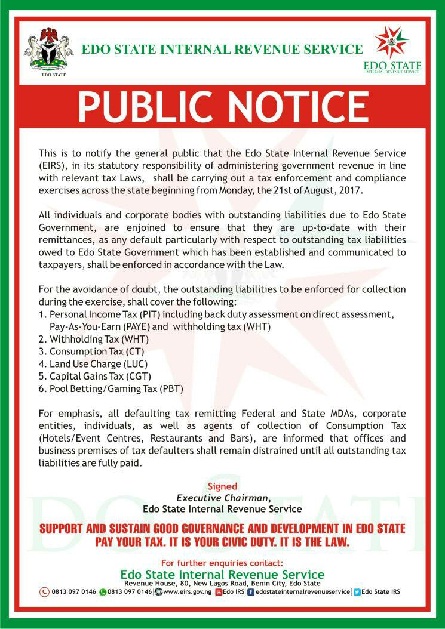

Edo State Internal Revenue (EIRS) has said it will carry out tax enforcement and compliance exercise beginning from Monday, August 21, 2017.

In a release made available by the Corporate Communications Unit, and signed by the Executive Chairman/CEO stated that “All individuals and corporate bodies with outstanding liabilities due to Edo State Government, are enjoined to ensure that they are up-to-date with their remittances, as any default, particularly with respect to outstanding liabilities owed to Edo State Government which has been established and communicated to taxpayers, shall be enforced in accordance with the law.”

The outstanding liabilities to be enforced, according to the release, are Personal Income Tax (PIT), including back duty assessment on direct assessment; Pay-As-You-Earn (PAYE) and withholding tax.

Other includes Consumption Tax, Land Use Charge; Capital Gains Tax and Pool Betting/Gaming Tax.

The EIRS Executive Chairman further stated that all defaulting tax remitting Federal and State Ministries, Departments and Agencies (MDAs), Corporate entities, individuals, as well as agents of collection of consumption tax (Hotels/Events Centers, Restaurants and bars), offices and businesses premises of tax defaulters shall remain distrained until all outstanding tax liabilities are fully paid.